36+ How is borrowing capacity calculated

Standard borrowing capacity is between 30 and 40 of income which means that debt should never exceed 13 of the individuals remuneration. The borrowing capacity formula.

Sc 20201231

Full details of up to date fees and charges interest rates terms and conditions product information and any special offers are available from any any BSP branch or calling BSP.

. No1 Place In Australia To Find The Perfect Property. If interest rates were to increase the banks want to make sure that you can repay them at an increased rate. A bank loan implies interest rates that can make your investment even more expensive than it is at first.

Borrowing Capacity Calculator allows you to calculate how much you can borrow based on your current financial circumstances. Interested in knowing how our funding solutions solve your business cash flow needs. View your borrowing capacity and estimated home loan repayments.

To make sure you can use the Borrowing Capacity Calculator to its full potential weve put together explanations of each field how it impacts the calculation and any. Examine the interest rates. The first step in buying a property is knowing the price range within your means.

You can get an estimate for this amount through a mortgage pre-qualification or for more certainty a. Lenders generally follow a basic formula to calculate your borrowing capacity. How many boxes do you need to move.

If you want a more accurate quote use our affordability calculator. Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes. Buying or investing in.

Borrowing capacity is calculated by lenders based on their assessment rate allowing them to assess whether your current financial circumstances will allow you to service. Fast Easy Approval. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

Gross income - tax - living expenses - existing commitments - new. Comparisons Trusted Low Interest Rates. Your borrowing capacity is the maximum amount lenders will loan to you.

The Best Offers from BBB A Accredited Companies. The Bank of Spain advises that the. Call us anytime 1300 617 277.

Selling and buying real estate made easy by AQ Properties Call us on 02 8733 2083 for a chat and some helpful advice regarding your property. It takes into consideration your current income assets and. While there is a standard formula lenders follow lenders may assess your income or expenses.

Thus as part of calculating your borrowing capacity it is. Get a quick quote for how much you could borrow for a property youll live in based on your financial situation. The Maximum Borrowing Capacity Calculator provides you with an indication of how much Lenders are prepared to Lend according to your Income and Liabilities.

We take pride in spending the time to deeply understand our clients. Compare home buying options today. Your borrowing capacity is really made up of two elements 1 Servicing.

Calculate your borrowing capacity using this borrowing capacity calculator from Investment Real Estate. Ad 7 Best Personal Loan Company Reviews of 2022. Estimate how much you can borrow for your home loan using our borrowing power calculator.

Sc 20201231

Generating Lasting Wealth Springerlink

10 K

Sc 20201231

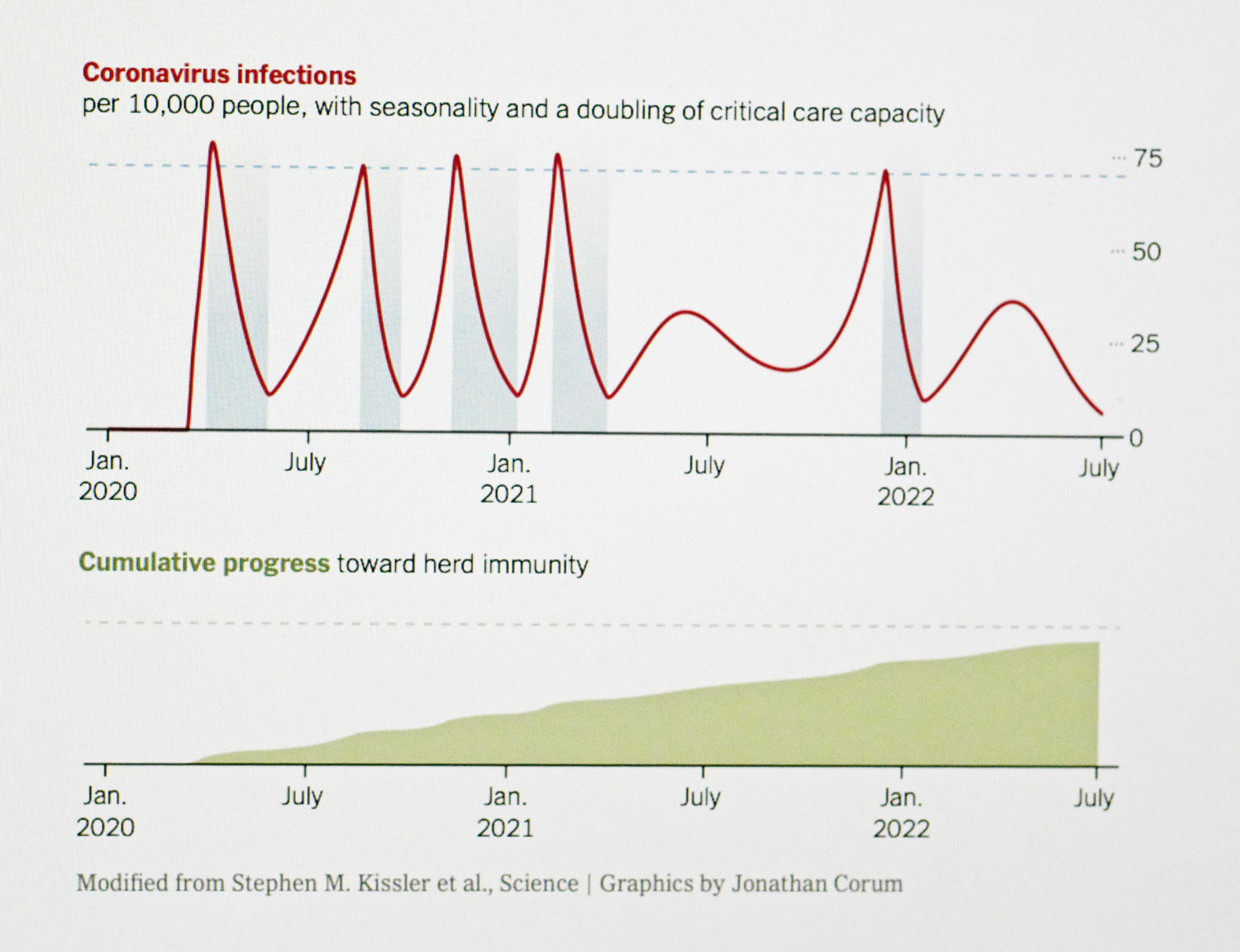

Covid Cyclical Seasonal Graph Jpg

2

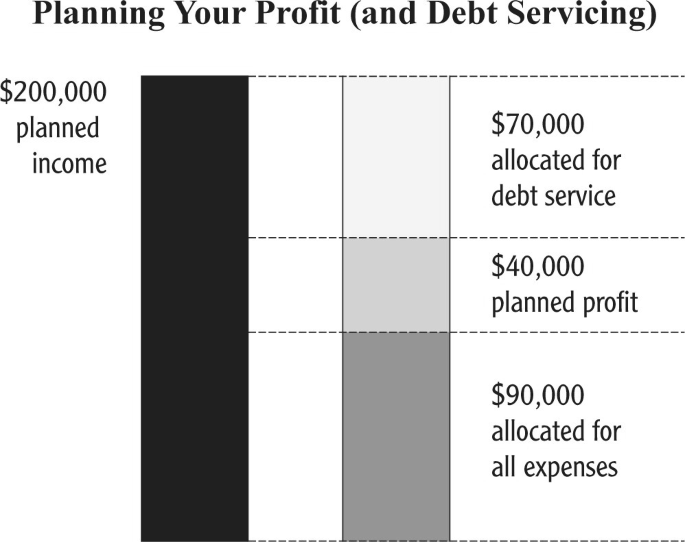

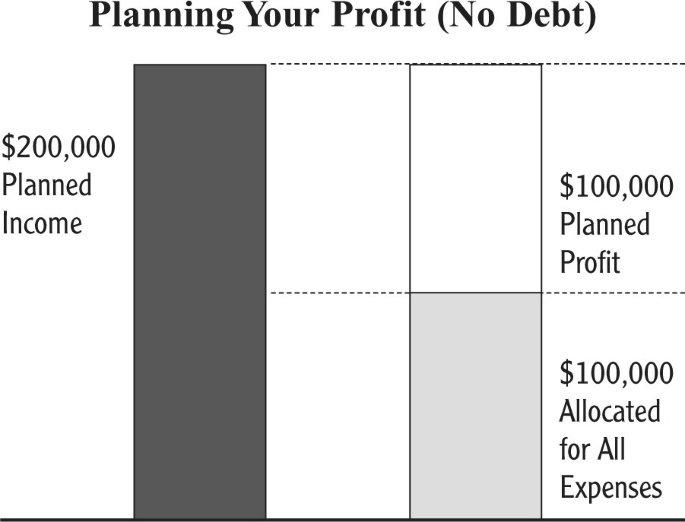

Generating Lasting Wealth Springerlink

Free Printable Loan Agreement Form Form Generic

Sc 20201231

10 K

10 K

Stocks Definition Financial Dictionary Fxmag Com

Generating Lasting Wealth Springerlink

Sc 20201231

Sc 20201231

All Gens Eevee An Introduction To Ev S Smogon Forums

Free 6 Bank Loan Proposal Samples In Pdf